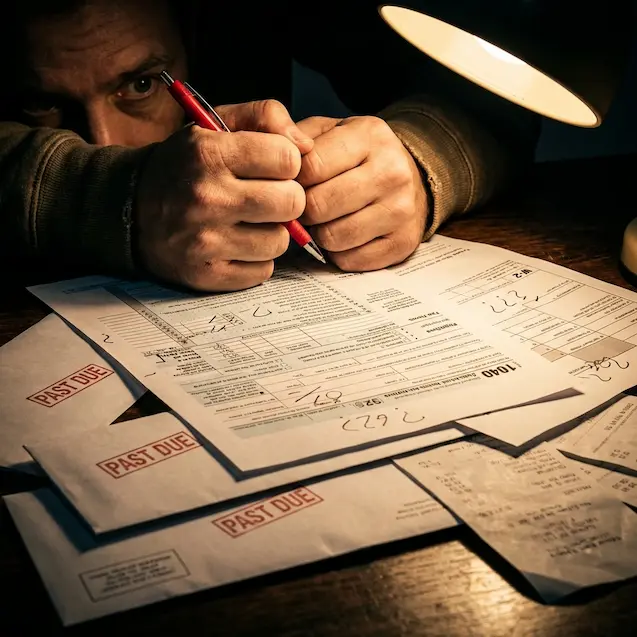

Stop Paying Taxes on Cash You Haven't Collected Yet.

Discover the audit-proof installment accounting system used to track 5,000+ land transactions with ease.

Enrollment includes lifetime access & 2026 updates.

Discover the audit-proof installment accounting system used to track 5,000+ land transactions with ease.

Enrollment includes lifetime access & 2026 updates.

Most CPAs don't understand land. If they treat your terms deals like cash sales, you are writing checks to the IRS for money that isn't even in your bank yet.

A few weeks ago, I met a guy named Brian.

He's a sharp guy, and he was interested in my business, and when I told him I was a Land Investor, his face dropped.

He told me, "My wife and I did that for a year. We loved it. But we had to quit."

I expected him to say he couldn't find deals or couldn't sell the land. But that wasn't it. They were selling land left and right.

"We stopped because we couldn't believe how much we were paying in taxes," he said. "We were paying more to the IRS than we were actually collecting in down payments. It bled us dry."

My heart sank. I knew exactly what happened.

Most CPAs default to Cash or Accrual accounting. Neither keeps you safe in land investing.

If you sell a property for $20k with $500 down, a typical CPA will tell you to pay taxes on the full $15k profit immediately.

The Installment Method allows you to book profit only as cash hits your account. This isn't a loophole—it's tax law. But if you don't know it, you're bleeding cash.

Years ago, Mark Podolsky (The Land Geek) had a killer year. Tons of deals. Solid margins.

Then his CPA dropped the bomb: “You owe nearly six figures in taxes.”

Mark wrote the check—then later found out the installment method could’ve cut that bill dramatically. Don’t be Mark (before he fixed it). Be smart from Day One.

Master the exact mechanism to defer taxes legally until the cash is actually collected.

The specific setup for QuickBooks or Xero designed specifically for the land business model.

Learn to record down payments, interest, and even the "impossible" edge cases with total confidence.

Build an audit-proof system you can hand to any bookkeeper to handle the day-to-day operations.

I created this system because I had to. I have an accounting degree, but even my CPA got it wrong at first.

This system has been refined across over 5,000 individual transactions. It is designed to be the "source of truth" for your business finances.

"I hesitated a year in taking this class... That was a big mistake. upfront investment in education would have saved a lot of effort now."

"Invaluable information if you intend to continue in this business. If you don't set up accounting right, you end up with a large tax bill."

"This was my second time and I'd pay for it again. You do a great job Scott! Very helpful even for accountants. :)"

I’m not asking you to "spend" money. I’m asking you to invest in saving it. If, after 12 months, this course has not saved you at least $999 in taxes, email my team for a full 100% refund. No questions asked.

This course is recorded and available 24/7. You will also have access to our 2026 recordings of our live class sessions.

Yes — a payment plan is available for this course. You’ll see options at checkout if enabled.

The principles apply to any system, but we provide specific setup instructions for QuickBooks Online and Xero, which are the industry standards for land investors.

Install the system. Keep what you earn. Scale with confidence.